Gelatin: An Ingredient of the Future

GROW’s global gelatin survey indicated that gelatin is widely used across various industries. Although alternatives, particularly plant-based products, have been explored in the past, the specific properties of gelatin continue to be sought after in the global market.

Summary

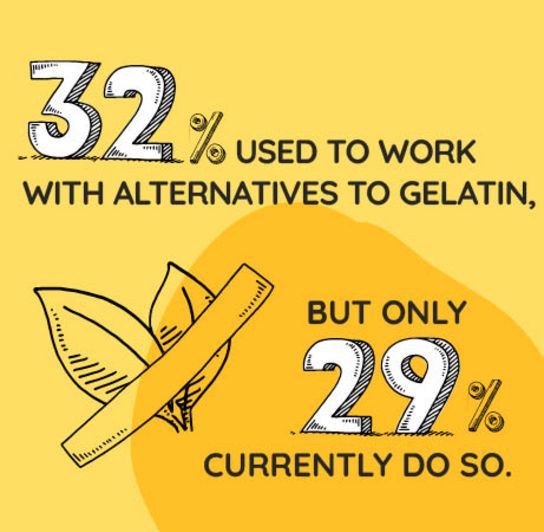

- 32 percent of participants have previously worked with gelatin alternatives but are not currently doing so.

- The global preference for plant-based alternatives is a significant emerging trend that could affect gelatin’s future use.

- However, the recognition of gelatin’s unique properties closely follows this trend.

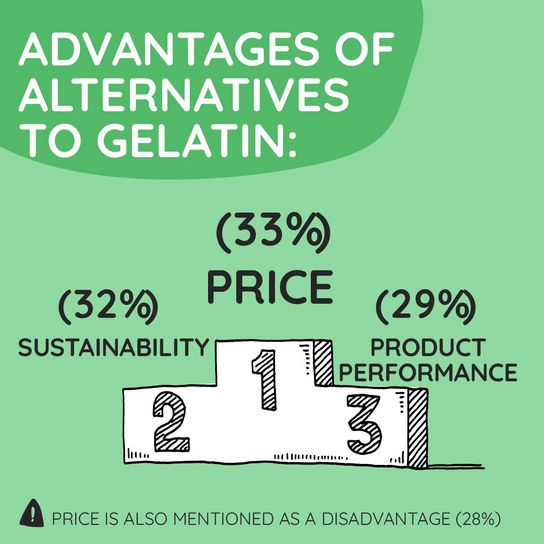

- Interestingly, price is seen both as an advantage (33%) and a disadvantage (28%) when it comes to using gelatin alternatives.

Have you or do you work with alternatives to gelatin?

The use of alternatives to gelatin reveals distinct trends across the globe. In the U.S. (31%), Germany (36%), France (44%), and South Korea (30%), a declining pattern is evident: the percentage of people who have used alternatives in the past is lower than the percentage of those currently using them. In contrast, Brazil (40%) and Japan (33%) show a different trajectory. Here, the proportion of current users of gelatin alternatives surpasses that of past users. These figures highlight significant regional differences in the adoption and acceptance of gelatin alternatives. The current use of gelatin alternatives varies significantly across different product categories. In the dairy sector, 36 percent of participants, and in the health & nutrition industry 38 percent, have experimented with alternatives in the past but have ultimately returned to gelatin.

In contrast, sectors like sweets (35%) and technical applications (35%) are adopting gelatin substitutes. These industries are the most likely to actively explore and implement alternatives.

What are the advantages and disadvantages you have encountered in exploring alternatives to gelatin in your department?

Participants evaluated gelatin alternatives from 11 options. Interestingly, "Price" emerged as both the top advantage (33%) and the top disadvantage (28%), reflecting the dynamic nature of the global market. Especially in food-related sectors, over a third mentioned "Price" on both sides. "Sustainability” ranked second as an advantage (32%), while “Consumer preference" was a challenge for 21 percent of participants. Market insights showed differences: nearly half of German respondents valued “animal welfare” in alternatives, while 38 percent in Brazil praised “product performance” and 35 percent reported no disadvantages.

Have you observed emerging trends or changes that impact or could impact the use of gelatin in your region (from consumers, stakeholders, competition etc.)?

Participants were also surveyed regarding emerging trends that could impact their future utilization of gelatin. The participants were permitted to select multiple answers from 13 options, providing a comprehensive perspective on the market. The most significant trend appears to be the increasing preference for plant-based alternatives, which accounted for a quarter of responses (25%). Market insights showed differences: nearly half of German respondents valued “animal welfare” in alternatives, while 38 percent in Brazil praised “product performance” and 35 percent reported no disadvantages. Despite this, gelatin maintains its relevance as it aligns with other highly scored trends (22%): the demand for minimally processed foods, Clean Label products, and gelatin’s distinctive properties. These support the continued use of gelatin.

In Brazil, gelatin stands out as a natural ingredient, perfectly aligned with the country’s strong demand for less processed foods, noted by 43 percent of participants. In Japan, 30 percent of participants highlight gelatin’s unique properties, emphasizing its irreplaceable qualities in various applications. Even in South Korea, where 36 percent of participants value plant-based alternatives, gelatin remains a key player. Its role in Clean Label products resonates with 31 percent of respondents, showcasing its ability to meet modern consumer expectations.

In the products that use gelatin, plant-based alternatives are seen as particularly trending in the dessert sector (32%), gelatin-based delivery formats (30%), and technical applications (33%). However, gelatin’s unique advantages are highly valued in technical applications (31%), along with its strong alignment with Clean Label trends.