GROW’s International Survey on Gelatin

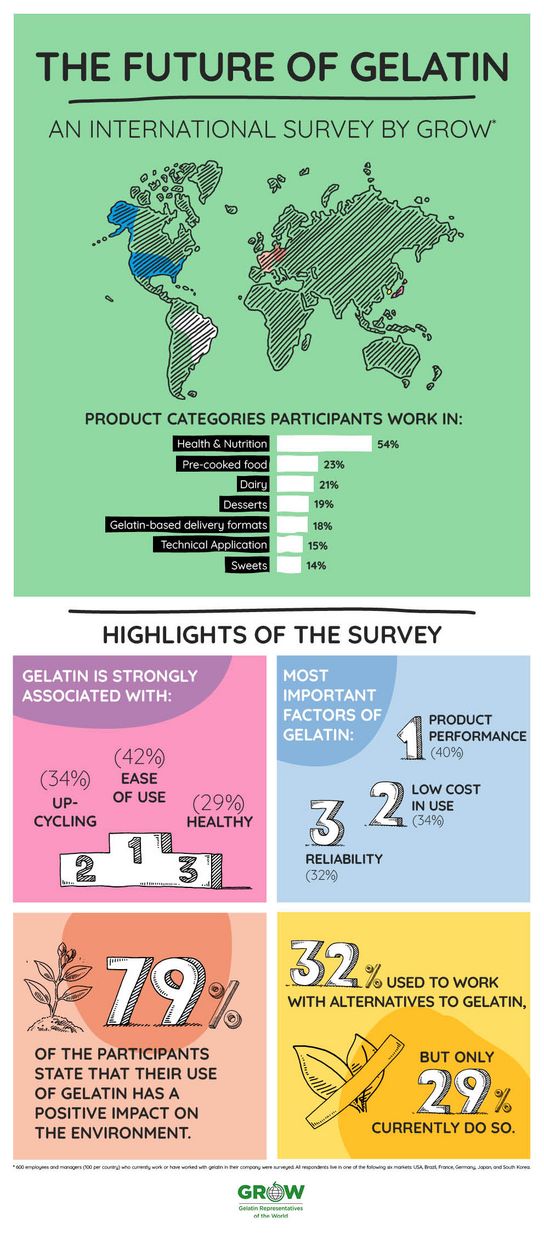

Gelatin serves as a crucial component in numerous industries. To evaluate its enduring relevance and future potential in the ever-evolving market, GROW initiated a global survey. This survey delves into three primary areas: the most valued properties of gelatin, its positive environmental impact, and the actual usage of gelatin alternatives. To ensure a balanced and global perspective, the study was carried out in six countries where the industry has a strong presence. For detailed information on the three focus topics and country-specific results, click through the menu and the blog article. Go to the interactive dashboard designed for in-depth exploration for the results of GROW’s comprehensive survey data in detail.

Summary

The results of the study reveal that gelatin is not only easy to use and healthy, but also environmentally friendly due to its upcycled nature. As upcycling gains traction among a growing number of companies, the use of gelatin aligns seamlessly with this emerging trend. Also, the unique properties such as product performance, cost-effectiveness, and reliability make gelatin a trusted and favored ingredient.

When it comes to potential substitutes for gelatin, the prevailing sentiment is that gelatin remains irreplaceable. Consequently, it can be concluded that the global industry will continue to rely on gelatin in the foreseeable future.

Survey Approach

In this survey, GROW interviewed 100 individuals from each of the following six countries: Brazil, France, Germany, Japan, South Korea and the U.S. The aim of the survey was to gain a better understanding of the perception of manufacturers who work with gelatin by asking questions on the use of gelatin, its sustainability, and potential alternatives.

To ensure a comprehensive and diverse set of results, we interviewed representatives from various departments within the industry, ranging from dairy to technical applications, all of which use gelatin in their products. This survey serves as an initial measurement of attitudes towards gelatin, shedding light on the benefits and drawbacks of this multifaceted product. The participants forming our panel were interviewed using a structured online questionnaire.

Overview of the Survey Results

To find out more, explore our infographic and click on the green flags for further information.

-

USA

Of all the participants in the U.S., 59 percent have worked with gelatin in the past and 41 percent are currently working in the context of gelatin. 58 percent state that they have a basic understanding of gelatin and 30 percent have a deeper understanding. Overall, most participants in the U.S. work in the product categories “Health & Nutrition” (53%), “Pre-cooked food” (32%) and “Dairy” (25%).

-

Brazil

Of all the participants in Brazil, 60 percent have worked with gelatin in the past and 40 percent are currently working in the context of gelatin. 46 percent state that they have a basic understanding of gelatin and 36 percent have a deeper understanding. Overall, most participants in Brazil work in the product categories “Health & Nutrition” (53%), “Desserts” (28%) and “Pre-cooked food” (23%).

-

Valued attributes of gelatin

Among the participants, the most valued attributes of gelatin are “Ease of Use” (42%), “Upcycling” (34%), and “Healthy” (29%). The participants could choose among 10 options with multiple choices.

In addition to "upcycling" (58%), South Korea also ranks "ecologically sustainable" with 36% higher than other countries. For Brazil, the attribute “healthy” is particularly important at 53%. Japan highlights the attribute ethical with 30%. In Germany, the “importance for our products” is crucial for 34%.

-

Important factors of gelatin

The participants were also asked which factors are the most important for companies when using gelatin. Again, they could choose between 8 options, multiple answers possible. “Product performance” is in first place with 40 percent, followed by “Low cost of use” for over one third of the participants and “Reliability” with 32 percent.

Sustainability is ranked highest for both, the U.S. (45%) and South Korea (44%). In Germany, reliability is also particularly important with 45% and low cost in use with 42%. France emphasizes price with 35%. Brazil is one of the few countries where consumer preference plays an important role (33%).

-

Positive environmental impact

A total of 79 percent approve the positive environmental impact of gelatin, as it is for example a natural and upcycled product. In fact, 71 percent of participants are aware that gelatin is an upcycled product.

Brazil ranks the positive impact of gelatin highest with 89%, closely followed by South Korea with 88%. However, the environmental impact is also significantly positive for the other countries. The U.S. with 79% is followed by France with 70% as well as Japan (79%) and Germany (68%).

-

Gelatin remains essential

Although alternatives to gelatin are in trend, they are not yet able to compete with the properties of gelatin. The actual use shows the preference for gelatin: 29 percent do currently work with vegan substitutes, down from nearly one third of the participants in the past.

This is also reflected in the majority of country data:

In the U.S., Germany, France and South Korea, a trend away from alternatives to gelatin is discernible. They have tried alternatives to gelatin, but only a few are currently working with it. The biggest difference is in Germany with 36% to 24% directly followed by France with 44% to 33%. Only in Brazil and Japan the proportion of people currently working with alternatives to gelatin is higher than in the past.

-

France

Of all the participants in France, 58 percent have worked with gelatin in the past and 42 percent are currently working in the context of gelatin. 59 percent state that they have a basic understanding of gelatin and 31 percent have a deeper understanding. Overall, most participants in France work in the product categories “Health & Nutrition” (70%), “Gelatin-based delivery formats” (18%) and “Dairy” (17%).

-

Germany

Of all the participants in Germany, 58 percent have worked with gelatin in the past and 42 percent are currently working in the context of gelatin. 53 percent state that they have a basic understanding of gelatin and 26 percent have a deeper understanding. Overall, most participants in Germany work in the product categories “Health & Nutrition” (64%), “Dairy” (33%) and “Pre-cooked food” (31%).

-

South Korea

Of all the participants South Korea, 70 percent have worked with gelatin in the past and 30 percent are currently working in the context of gelatin. 71 percent state that they have a basic understanding of gelatin and 21 percent have a deeper understanding. Overall, most participants in South Korea work in the product categories “Health & Nutrition” (55%), “Desserts” (32%) and “Pre-cooked food” (30%).

-

Japan

Of all the participants in Japan, 39 percent have worked with gelatin in the past and 61 percent are currently working in the context of gelatin. 40 percent state that they have a basic understanding of gelatin and 37 percent have a deeper understanding. Overall, most participants in Japan work in the product categories “Health & Nutrition (29%), “Technical application” (21%) and “Pre-cooked food” (17%).